For gifts of publicly traded stock the donor must still file a form 8283 if the value is more than 10000. Most people make donations in the form of goods or services rather than cash.

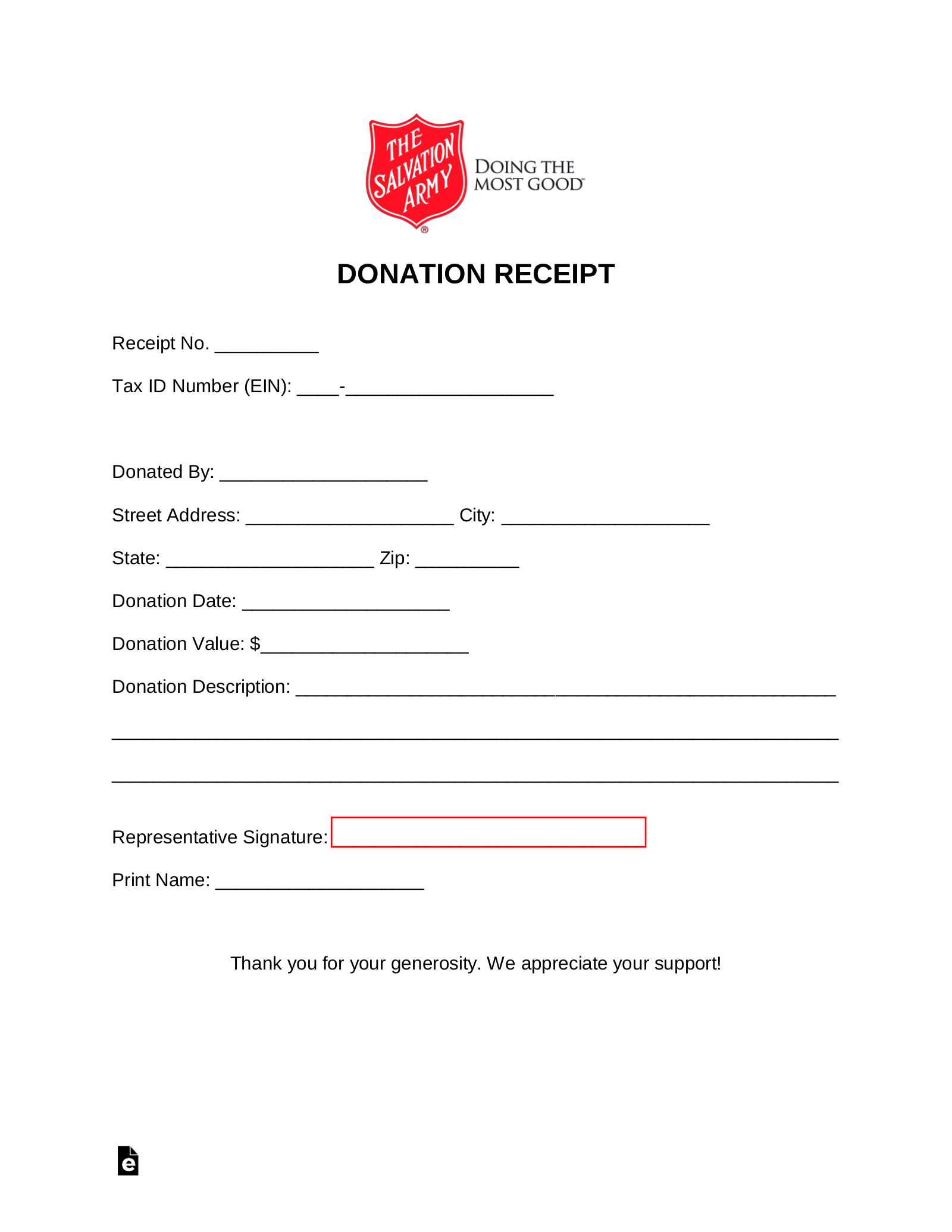

A gift acknowledgement letter is written by organizations who have received a donation from an individual or a company.

Stock gift receipt template. If the stock was used to pay a pledge that has already been entered you can skip this step. Because the value is based on the value on the date of the gift the charity should acknowledge receipt of xx shares of stock on the date it was received. Many organizations have a gift policy which requires that gifts of stock are liquidated upon receipt.

If you are using quickbooks go to receive payments. To record the receipt of stock you will want to set up an invoice under the donors name for the full market value of the stock. In line with this in kind gift receipts serve as a proof that such donations took place.

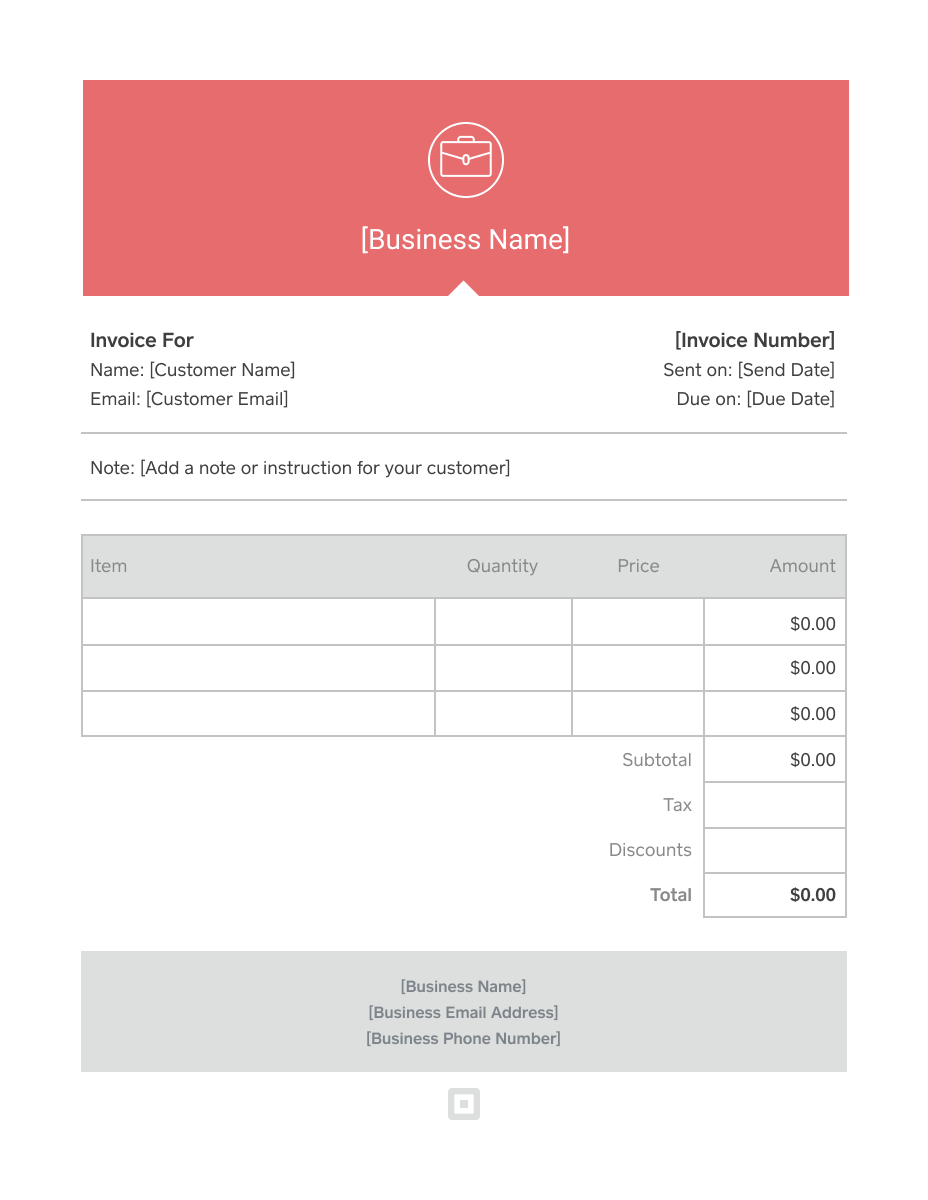

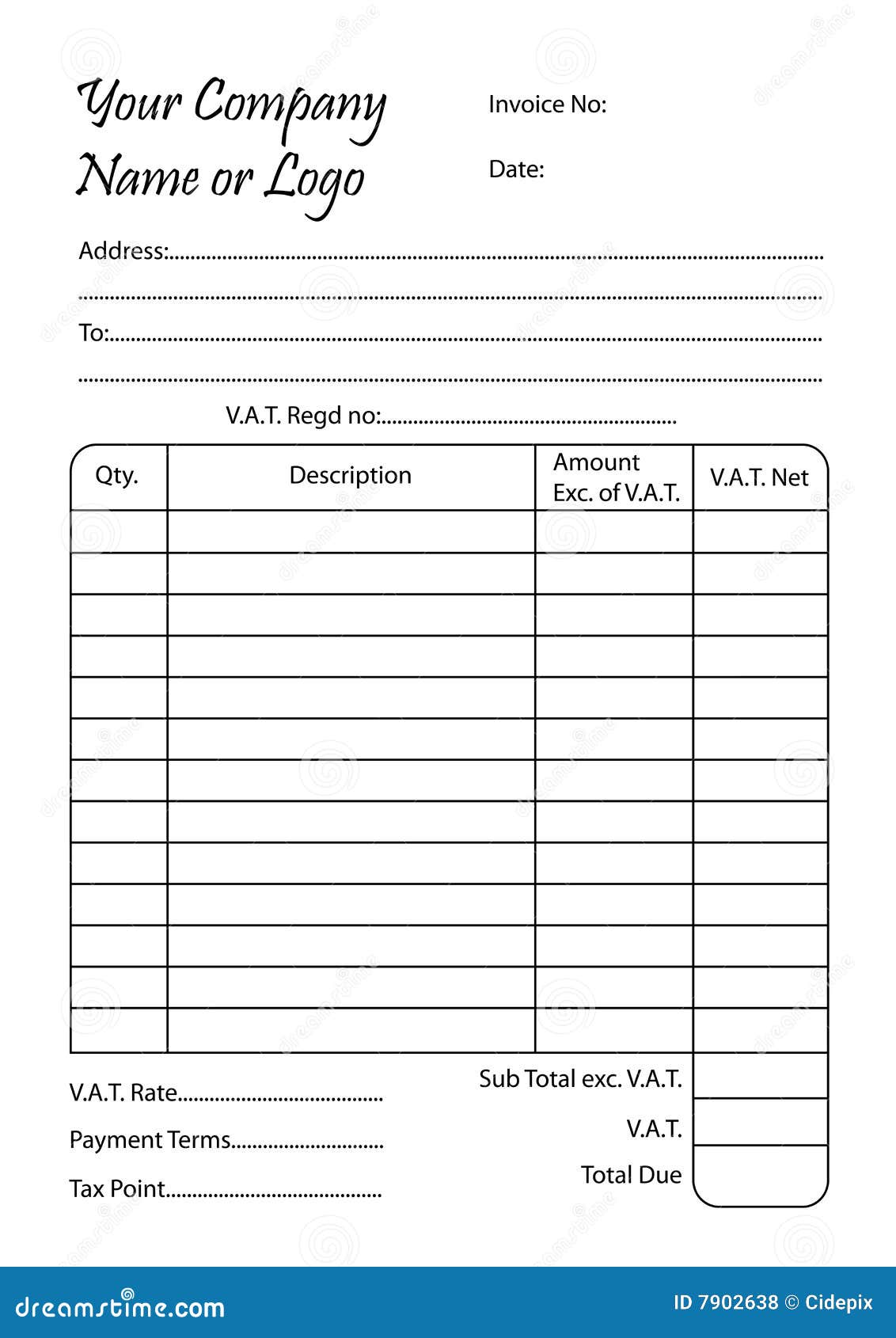

Exceed legal requirements by sending gift receipts and acknowledgments for gifts of any amount. There are many types of receipt templates including delivery receipt templates cash receipt templates rent receipt templates sales receipt templates donation receipt templates and purchase receipt templates. Example to only describe what was donated on a tax receipt see irs publication 1771.

This is referred to as in kind donation. In other words if a donor gives you 15 shares of microsoft corporation stock then the receipt should only state that no value or gift date information should be included as is true for all noncash contributions. Dont fall into this trap.

The donor can determine the value according to irs rules. Enter the amount as the full market value. B the donor bill of rights identifies appropriate acknowledgment as among a donors rights.

Use these free microsoft word templates to create a receipt for your small business or personal financial dealings. It is very common for nonprofit organizations to receive donations of stock especially at the end of the year as this is an effective way for donors to give to nonprofits that fits into their overall personal tax planning. How to receipt a stock gift.

It may be tempting when stock is received as a gift to sell the stock and record the amount received from the sale on the donors statement of giving as their charitable gift. If you try to examine our in kind gift receipt sample template it is a. What are in kind gift receipts and how do they work.

The letter provided by cynthia housel the organizations major gifts officer for the western united states includes the name of the stock the number of shares and the highest and lowest values of the stock on the day of receipt. A even if issuing a receipt is not legally required due to the amount of the gift many donors believe that it is. Now to the nitty gritty.

Gifts of stock require special written receipting which should include. It serves as a formal confirmation that the donation has already been given to them and can already be used for the purpose that it may serve the organization with.

:max_bytes(150000):strip_icc()/010-free-receipt-templates-for-microsoft-word-1356326-3aeffc70ed05438ebaba879e17579045.jpg)

0 Response to "Stock Gift Receipt Template"

Post a Comment