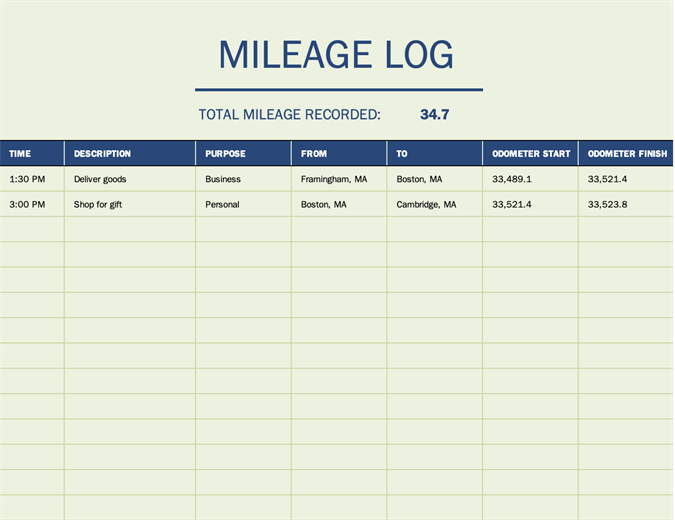

Mileage claim form for company car drivers. In the above example if your total mileage for the year were 6250 miles.

The amount claimed and the total amount sanctioned must be clearly stated in the claim form.

Mileage claim form template excel. It will enable you to. This mileage log template is for drivers who use a company car. Use the correct hmrc rates for your vehicles engine type and size.

Claiming business expenses as an employee means that you are not out of pocket on money paid out. You can also record your mileage on the excel template on the go. 5 mileage log form.

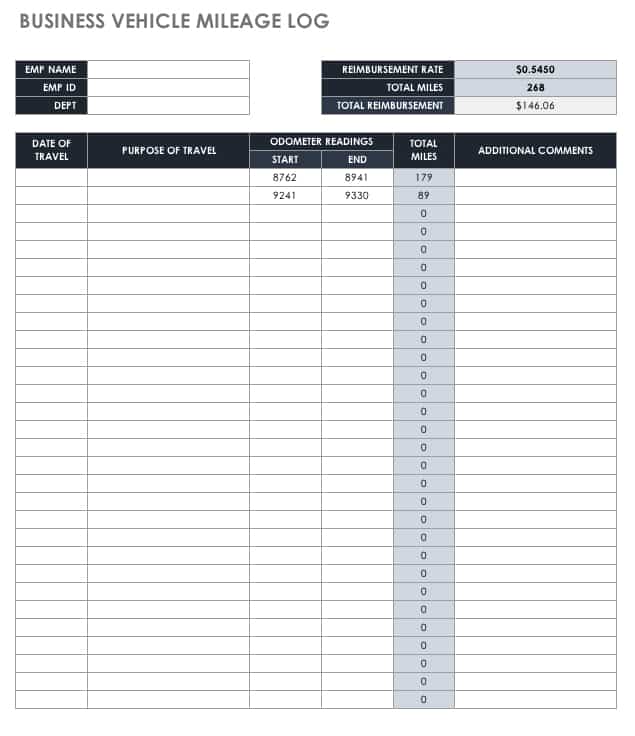

A mileage log reimbursement form in excel is a critical document used for preparing a record about daily travel mileage for the purpose of refunding amount from organization. 3 mileage log book. As self employed it can help to reduce your tax bill.

For this reason a standard expenses spreadsheet that logs all business mileage is always a good idea. I have also added a new printable pta reimbursement form. Keep track of your total business and personal mileage.

4 types of business driving that qualifies. Calculate and reclaim your full vat entitlement. 6 mileage that doesnt qualify.

2 contents of a mileage log. For travel you can use the travel expense form or mileage tracker but for these other expenses a general reimbursement form will suffice. You just need to give the information to the taxman in a consistent well presented way.

1 mileage log templates. This expenses form template for excel has automated everything making vat calculations a breeze on any type of expenses. Many business owners are able to deduct the costs associated with their vehicle expenses for repairs and the miles its driven.

Mileage log and expense report. Report your mileage used for business with this log and reimbursement form template. All you need is a simple spreadsheet for this type of form so our employee expense reimbursement form below is just the thing.

Note theres no prescribed hmrc approved mileage claim form template. Our expenses form is free to download and big on features to make processing employee expenses really easy. Mileage and reimbursement amounts are calculated for you to submit as an expense report.

For instance if you determine that 80 of the total mileage was for business purposes and the total vehicle expenses added up to 5000 the deductible expense using the actual expense method would be 4000 80 of 5000. The mileage reimbursement form template will give all the necessary details of your travel such as the purpose of visit departure and arrival dates a period of stay mode of journey and original expenses supported by receipts.

0 Response to "Mileage Claim Form Template Excel"

Post a Comment